- +962 6 4024 999

- jordan@halaloffice.com

- Saturday- Thurday: 9:00 - 18:30

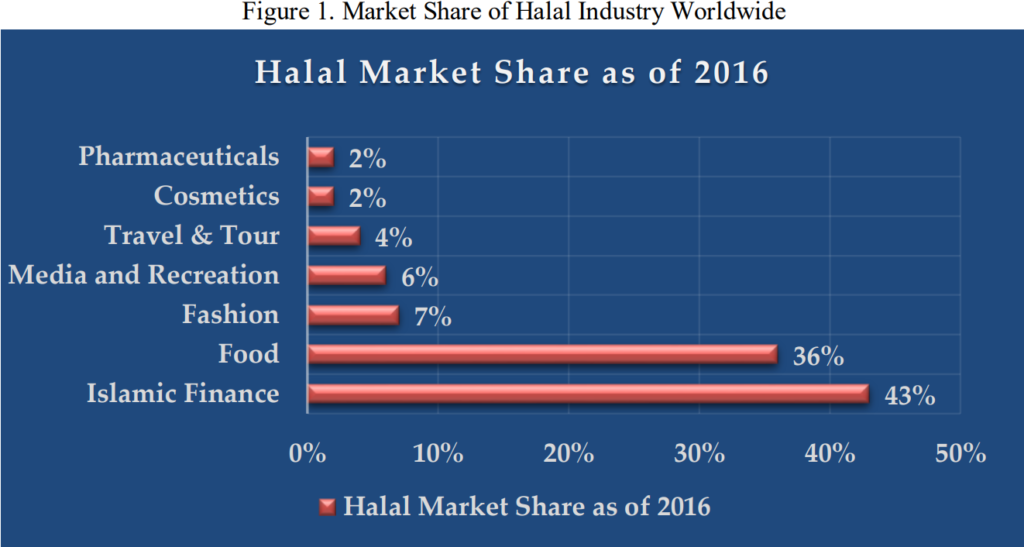

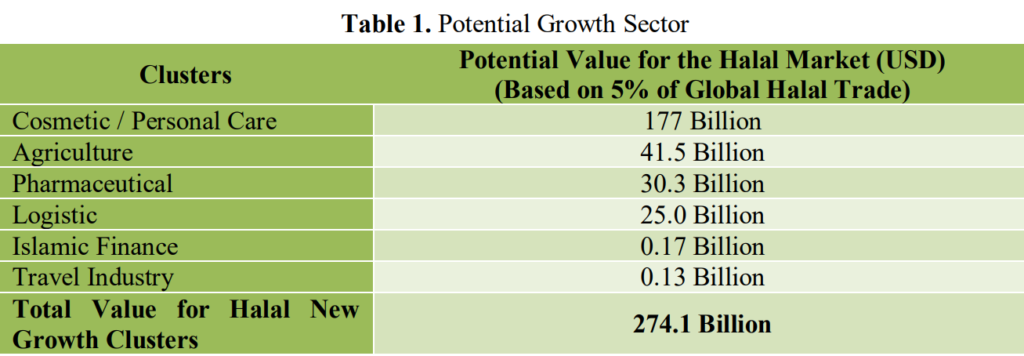

The halal market is no more limited to the boundary of food sector, rather it has extended its scope to include cosmetics and pharmaceuticals, toiletries and medical devices as well as service sector components such as logistics, marketing, print and electronic media, packaging, branding, and financing and so on. The global industry as a whole is estimated to worth around USD2.3 trillion (excluding Islamic finance) a year (“Global halal market – Statistics & Facts | Statista,” n.d.). The concept ‘halal’ also associates the concept ‘Toyyib’ meaning good.

Thus, the meaning of ‘halal’ is anything which is permissible in Islam and good for human being. The integration of ethical values along with religious values opens up the boundary of halal industry from 2.8 billion Muslim consumer to non-Muslim consumer as well around the world. It is well accepted by non-Muslim consumers as a life style choice because of the values promoted by halal industry such as animal welfare, social responsibility, environment friendly, stewardship to earth, economic and social justice, and ethical investment (Pacific, 2010).

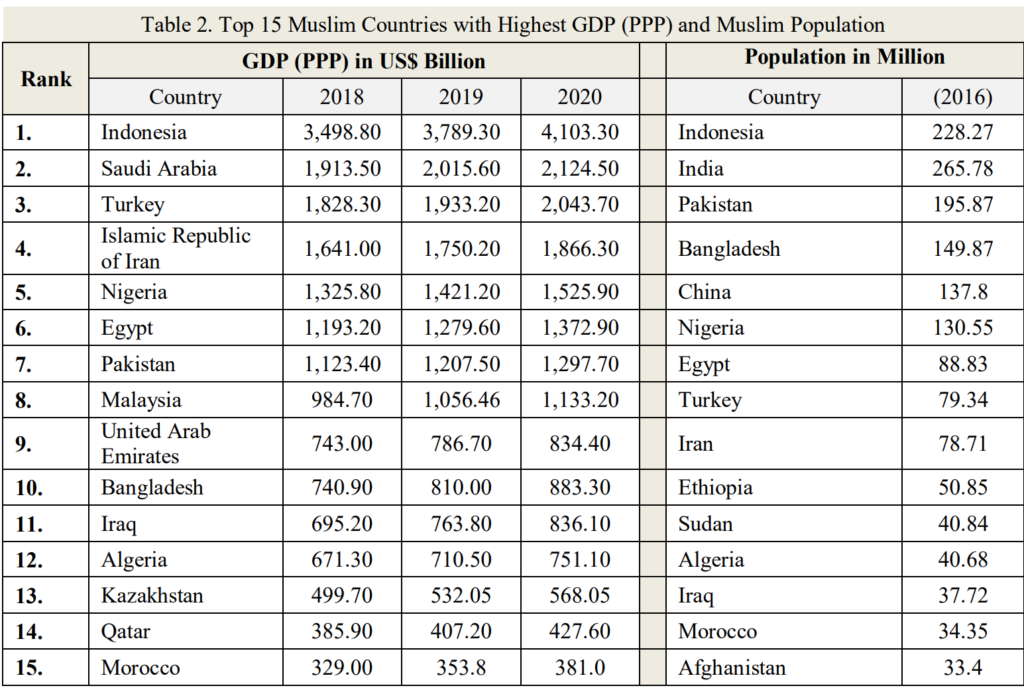

Current Muslim population is 2.18 billion which is 28.26% of the total population is increasing at 1.84% a year (“Muslim Population in the World,” n.d.). As the consumer size is increasing, the market size of halal industry is also increasing at an annual rate of 20% with a value of USD 560 billion a year (Pacific, 2010). Moreover, Muslim average per capita income (GDP) has risen from USD 1763 to USD10,728 from 1993 to 2015 and the 57 OIC countries have a combined GDP of USD 27.9 trillion (“Economy of the Organization of Islamic Cooperation,” Wikipedia, 2015).

It seems that non-Muslim countries have realized the opportunities and potential growth of halal market and putting effort to lead in this sector of the world’s economy. For example, Brazil, Australia, and Singapore are in the list of top ten countries with highest GIEI (Global Islamic Economy Indicator) score in halal food market in 2017-2018, although they are non-Muslim countries (Latif, 2017).

In halal food industry, the largest market is meat and poultry which is, surprisingly, led by non-Muslim countries. New Zealand and Australia is leading worldwide in exporting halal meat. Brazil and Argentina, at the same time, are the biggest poultry producer (Nor Ai’han Mujar, 2015).

While the Halal industry exhibits its’ potential growth globally, Muslims lack awareness on Halal and the prospect of this industry (Yunos, et al, 2014). For all the Muslim countries, it is now the essence of time to identify and realize the opportunities and potentials of global halal market and occupy the leading positions worldwide.

The awareness on the opportunities has to be made at all levels including government, academics, business entrepreneurs, corporate industries, policy makers, and as well as consumer level. Moreover, issues and challenges faced by halal industry should be identified and addressed by policy makers, researchers, academics, governments and respective authorities.

Thus, the purpose of this paper is to realize the current situation and prospects of global halal industry. It also investigates the factors that determines the rapid growth of global halal market. The final objective of the study is to address some of the issues and challenges in global halal market and provide recommendations accordingly. The findings of the study can be used to make awareness on the realities and opportunities of global halal market. Government and policy makers can use the results to develop policies and programs improving halal markets in respective countries.

The term ‘halal’ comes from the Arabic word namely halla, yahillu, hillan, wahalalan which means allowed or permissible by the Shariah law. According to Sharia’h law, every Muslim must ensure whatever they consume comes from a halal source. This confirmation shouldn’t be limited to only ingredients but also the whole process of production and services (Zakaria 2008). In another words; Halal is defined as lawful, beneficial, and not a serious threat or harm to human.

Haram, on the other hand, was perceived as the opposite and the degree of being beneficial or harmful decides the ranks of shriah order based on the based on the subject on specific time, place, and necessity. The definition given by Jabatan Kemajuan Islam Malaysia (JAKIM), in Trade Description Order 2011, covers products and services encompassing all the business operations like packaging, marketing, manufacturing, logistic, supply, maintain premises, slaughtering and so on (JAKIM, 2015). Realizing the significance of halal and its impact on the global economy, FAO (Food and Agriculture Organization) of United Nations has also prepared guidelines for using the term ‘halal’ to be adopted by its member countries (Ager, Abdullah et.al 2015).

Global Halal Industry

The concept ‘halal’ which is not anymore confined to food only, has made the halal industry a new potential growth sector in the global economy. The industry is growing at 20 percent per year estimating a value of USD 560 Billion and the total estimated value is USD 2.3 Trillion. This value excludes Islamic Finance which also growing rapidly (Elasrag 2016). The industry is rapidly spreading its wing in the economy globally. It is no more limited to only 1.8 billion Muslims only, rather it is also the market for non-Muslims.

Besides Malaysia, other countries like China, Thailand, Indonesia, Singapore, Korea, Philippine, and Australia have already tapped on the market. Many non-Muslim majority countries have realized the potential of the halal industry. In fact, some countries like Brazil, Australia, New Zealand, Italy, India, Germany are occupying the top ten positions in GIEI score in different halal sectors.

According to the study by Elasrag (2016), the halal Industry has extended not only its product sectors like pharmaceuticals, health products, toiletries, and cosmetics, but also in-service sectors like marketing, supply chain, logistic, packaging, manufacturing, branding, and financing. the study also implies that lifestyle offerings like travel & tourism, hospitality management, and fashion industry are now also a major sector of extended halal industry.

Opportunities and Driving Forces of Global Halal Market

There are certain factors that drive the rapid growth of halal industry globally. These factors may include Muslim population around the world, GDP growth of Muslim countries, emerging halal markets, Muslim lifestyle offerings, and the growth of halal ecosystem. These driving forces, however, also indicate the underlying opportunities of halal industry in global economy. The following section identifies the mentioned factors as driving forces and shows the opportunities of global halal industry.

Growing Muslim population

The rapid growth of Muslim population around the world is the factor that driving the expansion of global halal market most. The global population is set to reach 8.3 billion and by the time Muslim population is projected to be 2.1 billion (Latif, 2017). However, recent data shows Muslim population already represents 28.26 percent of the world population

which is 2.18 billion (“Muslim Population in the World,” n.d.). Millennial is also known as Generation Y, a driving factor in the growth of economy as well as global halal industry.

It is them who address the needs of Muslim millennials and set the brands by bringing changes across retail economy. They are the driving force in terms of entrepreneurship, innovation, technology savvy, and potential strength. By 2027, Millennials are set to 2.8 billion of world’s population as core consumer force. At the same time, Generation Y amongst the OIC countries will be reaching to 0.7 billion with an increasing average age 28.2 which is less than the age of global young population (Latif, 2017). As the fastest growing religion in terms of population, Islam is projected to be the most popular religion by 2070, which is another significant sign of halal industry growth (LIPKA, 2017).

GDP Growth in Muslim Countries

Gross Domestic Product by purchasing power parity or GDP (PPP) is another driving force of global halal industry growth and it is one of the economic tools to measure the potential strength of an economy. The definition of GDP (PPP) given by world bank is “the number of units of a country’s currency required to buy the same amount of goods and services in the domestic market” compared to the United States market; based on the US dollar.

As the size of population is growing, Muslim average per capita income (GDP) has risen from USD$1763 to USD$10,728 from 1993 to 2015 and the 57 OIC countries have a combined GDP of USD27.9 trillion (“Economy of OIC,” Wikipedia, 2015).

The purchasing power of Muslims as well as consumers around the world is also growing with the growing GDP of respective countries. Table 2 shows the GDP (PPP) of top 15 countries and their Muslim population.

Global GDP, in PPP terms, is set to reach $168 trillion with a growth rate of 5.8 percent in between 2016 and 2022. China, however, is already surpassing the US GDP in 2014. OIC countries, on the other hand, represented $18.3 trillion in PPP terms which was 15.3 percent of the global economy in 2016. The 57 Muslim majority OIC countries are set to grow by 6.2 percent between 2016 and 2022 (Thomson Reuters Global Islamic Economy Report 2017/2018).

The report also indicates China as the game changing player in the Islamic economy trade. The “One Belt One Trade” initiative of China involves 28 OIC countries and stands to benefit from $3 trillion in infrastructure-related investments.

Export is also a major contributing component to the GDP of a country. Halal export is projected to surpass $1 billion by 2030 from a total of $50 million in 2016.

The export ecosystem of Halal industry is comprised of four components. Sustainable inventory, which is developed through animal import and breeding, shipped 0.5 tons per year. Then, advanced processing led by multinationals, employed over 5000.

Third component is certification which is leading world-class Halal certification and accreditation. Finally, finance that makes funds available for SMEs (Thomson Reuters Global Islamic Economy Report 2017/2018).

Emergence of Halal Markets and Players

In many countries around the world the industry players have a lot of campaign that creates indirect awareness on halal products and services that results Halal market force. Consumers around the world are becoming aware of the importance of Halal, not only in terms of food consumption, but also the ethical values integrated to it, e.g. Muslim friendly tourism (MFT), modest fashion, logistic, pharmaceuticals and many others. The trillion-dollar business in halal industry is the result of this emerging consumer need.

It is evident that Muslim majority countries like Malaysia, Indonesia, Saudi Arabia, and Pakistan and other non-Muslim countries are also leading in the GIE indicator score. However, the emerging markets in other countries like Thailand, Philippine, China, and Singapore show the potential growth in halal industry. The emerging markets of all these countries view halal as a means to stimulate the economy through exports, tourism, valueadd, trade, research, certification expertise, training programs, halal science symposium, raw material supplier and some other aspects (IMARAT Consultants, n.d.).

Some examples of emerging new players include Singapore’s supermarket MyOutlets, Japan’s Nippon Express in logistic services, Turkey’s Banvit meat company, U.K. based Willobrook Farm, Halal Exotic Meats, Asada’s, Honest Chop of U.S.A and many more.

Fleishman Hillard Majlis, 2011 in his book, “The New Silk Road”, introduces China as a potential emerging halal market. The city, Yiwu, is one of the examples mentioned in the book where more than 200,00 Arab national visit every year as it is the largest wholesale consumer goods market in China. Realizing the scope of halal industry, few initiatives have been taken in the trading zone e.g. availability of products that appeal to Muslim consumers, convenient commerce, prayer hall for nearly 10,000 Muslims to pray, and easy access to halal foods.

U.S.A. is another potential emerging market in halal industry. Data, recently reported by IMARAT Consultants, n.d. shows that 16% of the consumers for US Kosher market are Muslim. For every 1 halal product in the shelves of supermarkets there are 86 Kosher products. It also states that, US Muslims are spending more than $16 billion a year on Kosher products because halal products are not available there.

Similar scenario can be observed in the UK halal market which is growing at 15% with a national average of 1% annually. Moreover, countries around the world are emerging as market players competing each other in halal industry. A recent report by HDC, presented in Bio Malaysia & ASEAN Bioeconomic Conference, 2015, states several such emerging markets globally. For example, UAE visioning to become the center of Islamic economy, domestic halal economy in China is increasing by 10% per annum, Thailand as the largest producer of halal processed food visioning to become the kitchen of the world, Japan foresees Halal as key source of contributor to its economy by 2020, South Korea is visioning to become the main destination of halal tourism, and Brunei is visioning to become the Google for Halal (HDC, Bio Malaysia & Asean Bioeconomy Conference, 2015).

Challenges of Global Halal Industry

While in one side, the Muslim consumers around the world represent a great opportunity for halal industry, on the other side, it is also a great challenge to deal with the diversity of the same population. Although the religious belief of Muslims is the same around the world, they have their own culture, regional or local shades, preferences, and practices. This is because Muslims live in every country of the world representing most of the races and come from every social and economic stratum (Personal et al., 2009).

The growing Muslim population and the growth of halal industry could be under threat by the non-Muslim population as well. The non-Muslim manufacturers, especially in the food and beverage industry.

The unfriendly and malign act of introducing non-halal elements into foods, clothing, and other services claimed to be halal by the non-Muslim industry players poses a big challenge to the growth of halal industry globally. It may turn into a destructive threat as this intention of evil act by non-Muslims will decrease the halal integrity of the products and services and erode the confidence of the consumers (Personal et al., 2009).

One of the biggest challenges for Halal industry is establishing an internationally recognized halal standards and accreditation, especially in food sector.

The recent act of banning Halal and Kosher slaughter in Denmark along with negative stories about Halal foods in the media is a warning to global halal industry. It is to ponder about the negative attitude prevalent in Europe and USA towards Halal and take challenges to remove such perceptions which is crucial for future success of Halal food sector (Thomson Reuters and Dinar Standard, 2016).

The challenge of establishing Halal standards and accreditation is also pivotal to remove confusion surrounding halal standards both in consumer and producer level. There’s no international scheme to accredit Halal Certification Bodies (HCBs) in respective countries.

Moreover, the standards are being produced by different government-linked organizations, private agencies and HCBs, national bodies, regional bodies, and as well as international bodies such as SMIIC (Standards and Metrology Institute for the Islamic Countries) or OIC initiative.

Too many standards developing bodies create confusion to decide on which one will provide market access, and in many cases multiple certificates are necessary for exporters (Personal et al., 2009). Similar challenges were mentioned at Bio Malaysia & Asean Bioeconomy Conference, 2015 stating a capacity and capability gap among the certification bodies.

The challenge of coming up with universal Halal standards also prevails in terms of preserving halal integrity throughout the supply chain and logistics management from farm to fork. Dedicated efforts, appropriate policies, standards, and procedures should be developed to ensure zero contamination to non-halal materials/ingredients along the supply chain. The lack of awareness and imbalance supply chain can be the barriers for halal industry development (Bio Malaysia & Asean Bioeconomy Conference, 2015).

To be specific, the challenge lies in every sectors of Halal industry like food and beverage as mentioned earlier. For example, the Halal travel market faces challenges in terms of accommodation of both Muslims and non-Muslims in same hotel, lack of investment and shariah compliant funds, lack of common halal travel standards, dilemma in marketing, and no agreed definition of different terms used in the market e.g. Halal holiday, Muslim friendly, and Family oriented hospitality (Personal et al. 2009, Thomson Reuters Report 2017/18).

The modest fashion, an emerging market segment in halal industry, with plenty of opportunities is also facing challenges.

The regulations imposed by certain governmental agencies against religious attires put a big challenge for the industry to reach non-Muslim countries. other challenges in this sector include lack of marketing sophistication, lack of product innovation, and reluctance of investors to finance due to limited global success stories.

Halal media and recreation, another emerging market segment in the industry, that can experience substantial growth through multi-channel expansion, also holding risk and challenges at the same time to overcome. Unlike other sectors, getting financed and governmental support is a more promising challenge for this sector. The growth can also be hindered because of poor intellectual property (IP) rights that limits innovation as well as the sector to religious shows only.

Diversification in cultural and religious themed shows and addressing the demand of young generations also add to the challenges in this sector (Thomson Reuters Report 2017/18).

As the Muslims are becoming concerned more and more about what they consume, a number of companies are offering pharmaceutical and cosmetic products that are free from animal sourced ingredients. However, the segment is not free from challenges either. Lack of halal ingredients availability, potential investors, limited standardization, and the fear of being limited to Muslim consumers only are some of the challenges the market is to face to ensure its growth globally. (Thomson Reuters Report 2017/18).

Original Author: Md. Siddique E Azam, Moha Asri Abdullah